Last update images today Bike Insurance: Whats Covered Your Complete Guide

Bike Insurance: What's Covered? (Your Complete Guide)

This week, as cycling season ramps up, understanding bike insurance is crucial. Whether you're a seasoned pro or a weekend warrior, knowing what protection you have - or need - can save you a lot of headache and money. This comprehensive guide will break down everything you need to know about bike insurance coverage, ensuring you're fully protected on every ride. Target Audience: Cyclists of all levels, from casual riders to competitive racers, and those considering purchasing a bike.

What Does Bike Insurance Cover? Understanding the Basics

Bike insurance isn't just a "nice-to-have"; it's a safety net that protects you and your valuable equipment. The level of coverage can vary widely depending on the policy and provider. Let's dive into the core areas typically covered:

-

Theft: This is perhaps the most common concern for cyclists. Bike insurance policies typically cover theft, whether the bike is stolen from your home, garage, or a public location. Crucially, documentation such as photos of the bike and the serial number are vital when making a claim.

ALT Text: A high-security bike lock securing a bicycle to a rack.

Caption: Protect your investment; even with insurance, proper locking is key to deterring theft.

-

Damage: Accidents happen. Whether you collide with a vehicle, another cyclist, or simply crash, bike insurance can cover the cost of repairing or replacing your bike. This can include damage to the frame, components, and accessories.

ALT Text: A cyclist inspecting a damaged bicycle frame after a crash.

Caption: Don't let an accident derail your passion. Check your insurance for damage coverage.

-

Liability: If you cause an accident that results in injury to another person or damage to their property, liability coverage can protect you from significant financial burdens. This coverage pays for legal defense costs and any settlements or judgments against you.

ALT Text: A cyclist assisting another person after a minor collision.

Caption: Accidents happen. Liability coverage protects you and others.

-

Medical Payments: In the event you're injured in a cycling accident, medical payments coverage can help pay for your medical bills, regardless of who was at fault. This can be a lifesaver if you have high deductibles or limited health insurance coverage.

ALT Text: A cyclist receiving first aid after an accident.

Caption: Medical coverage can help ease the financial burden of recovery.

-

Uninsured/Underinsured Motorist: This coverage protects you if you're hit by a driver who doesn't have insurance or whose insurance is insufficient to cover your damages. This is particularly important in areas with high rates of uninsured drivers.

ALT Text: A bicycle lying damaged on the roadside after being hit by a car.

Caption: Protect yourself from uninsured drivers with specific coverage.

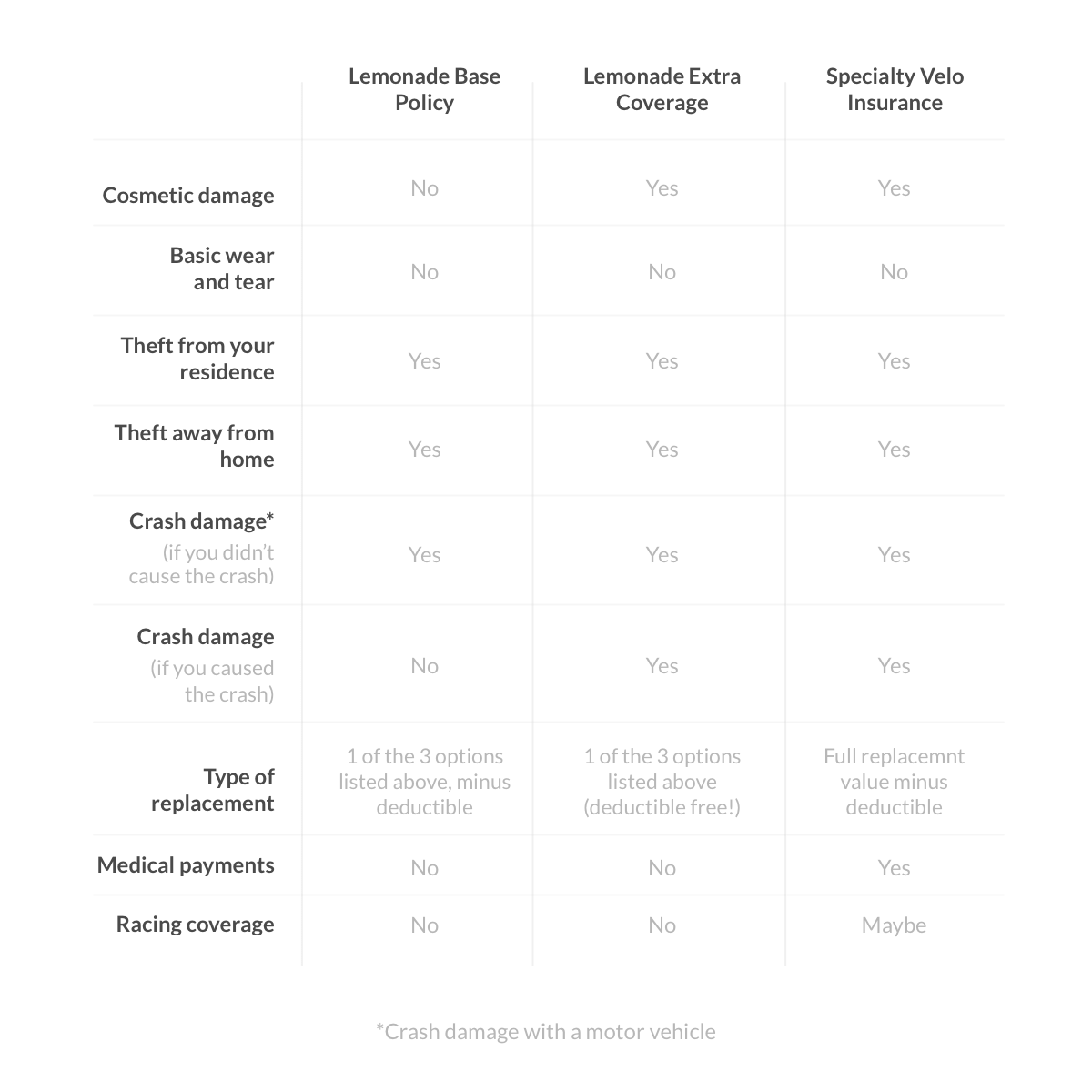

What Does Bike Insurance Cover? Policy Variations & Important Considerations

While the core coverages mentioned above are common, policies can vary significantly. Understanding these variations is essential to choosing the right insurance for your needs.

-

Replacement Cost vs. Actual Cash Value: Some policies will replace your bike with a brand-new model of similar value (replacement cost), while others will only pay the current market value of your used bike (actual cash value). Replacement cost is generally more expensive but provides better protection.

ALT Text: Two identical bicycles; one brand new, the other showing signs of wear and tear.

Caption: Choose replacement cost coverage for maximum protection against depreciation.

-

Deductibles: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually mean lower premiums, but you'll have to pay more if you file a claim.

ALT Text: A visual representation of a deductible: a larger initial expense followed by insurance coverage.

Caption: Carefully consider your deductible to balance premium cost and out-of-pocket expenses.

-

Coverage Limits: Every policy has coverage limits, which are the maximum amounts the insurance company will pay for a covered loss. Make sure the limits are high enough to cover the value of your bike and any potential liability claims.

ALT Text: A chart comparing different coverage limits for various insurance policies.

Caption: Ensure your coverage limits are adequate for your bike's value and potential liabilities.

-

Exclusions: All policies have exclusions, which are specific situations or events that are not covered. Common exclusions include wear and tear, racing, and using your bike for commercial purposes (e.g., food delivery) without appropriate endorsements.

ALT Text: A warning sign indicating "off-road use prohibited."

Caption: Be aware of policy exclusions; off-road riding may not be covered.

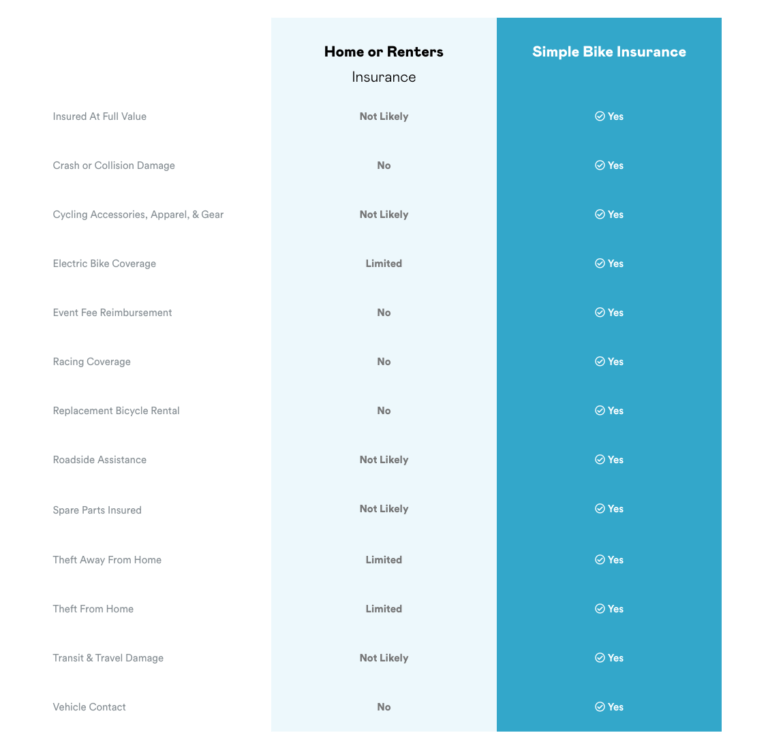

What Does Bike Insurance Cover? Homeowners Insurance vs. Standalone Bike Insurance

Many cyclists wonder if their homeowners or renters insurance provides adequate coverage for their bikes. While these policies may offer some protection, they often have limitations.

-

Homeowners/Renters Insurance: Typically covers theft or damage occurring within your home. However, deductibles are often high, and claims can impact your overall insurance rates. Coverage may also be limited for expensive bikes.

-

Standalone Bike Insurance: Offers more comprehensive coverage specifically tailored to the needs of cyclists. This often includes coverage for theft, damage, liability, and medical payments, even when you're away from home. Policies are typically designed for higher-value bikes, providing better protection for your investment.

ALT Text: A Venn diagram comparing Homeowners Insurance and Bike Insurance, highlighting overlapping and distinct coverage areas.

Caption: Understand the differences to choose the best protection for your needs.

What Does Bike Insurance Cover? Obtaining the Right Policy

Securing the right bike insurance policy requires research and careful consideration.

-

Assess Your Needs: Determine the value of your bike, your riding habits, and your potential risks.

-

Shop Around: Get quotes from multiple insurance providers to compare coverage options and premiums. Specialized bike insurance companies often offer the most comprehensive coverage.

-

Read the Fine Print: Carefully review the policy terms and conditions, including coverage limits, deductibles, and exclusions.

-

Consider an Umbrella Policy: For added liability protection, consider purchasing an umbrella policy, which provides additional coverage above your standard insurance limits.

ALT Text: A person comparing insurance policies on a laptop computer.

Caption: Informed decisions lead to better coverage; shop around and compare policies.

What Does Bike Insurance Cover? Real-Life Examples

-

Theft: Sarah's brand new road bike was stolen from her apartment's bike rack. Thanks to her bike insurance, she received a check for the full replacement cost of the bike, allowing her to quickly get back on the road.

-

Accident: John was involved in a collision with a car while cycling. His bike insurance covered the cost of repairing his damaged bike and also helped pay for his medical bills.

-

Liability: Emily was riding in a group when she accidentally collided with another cyclist, causing them a broken arm. Her liability coverage paid for the other cyclist's medical expenses and legal fees.

Question and Answer about "what does bike insurance cover"

Q: Does my homeowners insurance cover my bike if it's stolen outside my home?

A: Possibly, but coverage is often limited and subject to a high deductible. Standalone bike insurance usually offers better protection.

Q: What happens if my bike is damaged in a race?

A: Many policies exclude racing, so it's important to check the policy's exclusions before participating in competitive events.

Q: How do I prove the value of my bike if it's stolen?

A: Keep records of your bike's purchase price, serial number, and any upgrades you've made. Photos can also be helpful.

Q: Is e-bike coverage different from regular bike coverage?

A: Yes, e-bike coverage can be different, and some policies may require specific endorsements for e-bikes due to their higher value and potential risks.

Q: Who is eligible to buy bike insurance?

A: Anyone who owns a bicycle can purchase bike insurance. Policies cater to a wide range of cyclists, from casual riders to competitive athletes.

In summary, bike insurance covers theft, damage, liability, and medical payments. Choosing the right policy depends on your individual needs and riding habits. Remember to compare quotes and understand the policy's terms and conditions. Summary: Bike insurance protects against theft, damage, liability, and medical costs. Homeowner's may offer limited coverage. Carefully compare policies and understand terms. Keywords: bike insurance, bicycle insurance, cycling insurance, bike theft, bike damage, bicycle accident, liability coverage, medical payments, uninsured motorist, replacement cost, insurance deductible, homeowners insurance, e-bike insurance.

Does Renters Insurance Cover Bike Theft Does Renters Insurance Cover Bike Theft 300x169 What Is Bike Insurance And How Does It Work Forbes Advisor INDIA Pasqualino Capobianco F4fTVJIZlEw Unsplash 1 A Comprehensive Guide To Bike Insurance Everything You Should Know Comprehensive Guide To Bike Insurance 1200 x 675 Px Q963h5v3g2u5cywxum5gv5mjl46e51lntyjeyko1ag Bicycle Insurance Worth The Money Coverage Buckeye Law Group Closeupofsomeoneridingabike 1920w.webpWhat Does Bike Insurance Cover Costs And Coverage Explained What Does Bike Insurance Cover.webpBest Bicycle Insurance Right Coverage For Your Ride Best Bicycle Insurance 2048x1152 A 2024 Cyclist Buyer S Guide To America S Best Bicycle Insurance 657bccacae80c8bc935bc451 BikeTypes 2024 V5 COMP How Much Does Bicycle Insurance Cost Flat Iron Bike How Much Does Bicycle Insurance Cost 2

15 Best Road Bicycle Insurance Policies For Cyclists In 2025 Protect Bicycle Insurance For 2024 Does Bicycle Insurance Cover Theft Bedgut Com 0512 TI 003.webpBicycle Insurance Everything You Need To Know Simple Bike Insurance Comparison Table 2021 768x735 Is Personal Accident Cover Mandatory For Bike Insurance New Compare Save Upto 85 On Bike Insurance Mobile Pennsylvania Motorcycle Accident Insurance Coverage Does Insurance Cover Motorcycle Accidents In Pennsylvania 768x511 Is Personal Accident Cover Mandatory For Bike Insurance New Bike Insurance 1 3 Rs Everything You Should Know About Bike Insurance Online Policy Bike Insurance Coverage Does Bike Insurance Cover Theft Factors To Consider D6996db4d3d4bcad17ced60b2987f67d.webp

Bicycle Insurance Does It Exist And What Do I Need Bicycle Insurance Does It Exist And What Do I Need Sticker Round Bicycle Insurance Explained Comparisson What Is Bicycle Insurance Progressive Bicycle Insurance 2025 Bicycle Owner S Guide To The Best Bike EBike Insurance BikeInsure 655ba3a2328728294a8a976b IMBA SEAL In Footer Why Bike Insurance Is A Must For Adventure Rides 1738060986 659 Bike Insurance Online Renewal Detailed Guide To Renew Your Two Wheeler Compare Save Upto 85 On Bike Insurance Mobile Does Aetna Cover Wegovy 2025 Peggi Lyndsey 634dbaa5a23e9ed10a064274 Aetna Insurance What Does Bicycle Insurance Cover 5f5f04de4e6e4146b4f02415 Blog What Does Bicycle Insurance Cover

Best Bike Insurance Tips For Indian Riders In 2025 Bike Insurance Coverage Protection.webpDoes Renters Insurance Cover Bike Theft Does Renters Insurance Cover Bed Bugs Ultimate Guide To The Best EBike Insurance USA BikeInsure 64e6a1f15803cbdf59617ccd 2250x1500 EBIKE AUG2023 COVER COMP Does Renters Insurance Cover Bike Theft Does Renters Insurance Cover Power Surges Outages And Electronics Bicycle Insurance Market 2025 Share Forecast To 2034 241226 GMR Bicycle Insurance Market.webpHow Does Bike Insurance Works In India How Does Bike Insurance Work In India.webpDo Cyclists Need Insurance Your Options Explained 2025 Do Cyclists Need Insurance Your Options Explained Does Renters Insurance Cover Bike Theft Tenant Insurance Coverage For Bikes

How Much Does Bicycle Insurance Cost For 1000 3000 And 6000 Bikes How Much Does Bicycle Insurance Cost For 1000 3000 And 6000 Bikes Tips To Renew Your Bike Insurance Policy Bike Insurance Policy 57c7 Bike Insurance It S Benefits And What It Covers Bike Insurance